2020 WOPs Global Trends

The world of water service operators has had a lot going on in the past few years, and 2020 was no exception. With the unexpected impacts of the COVID-19 pandemic, last year brought many shifts to existing trends in the sector at large and to the Water Operators’ Partnerships (WOPs) as well that may indicate more of what’s to come in the future of water management.

2020 WOPs GLOBAL TRENDS

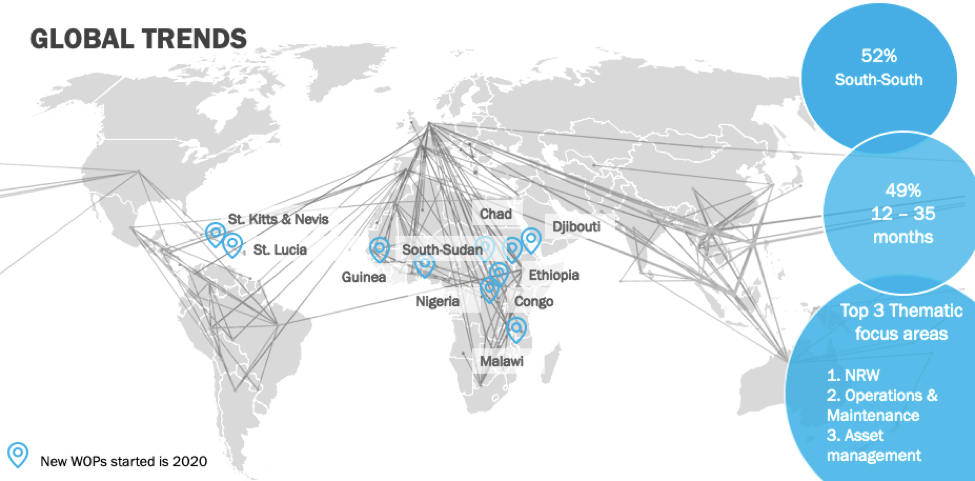

In reviewing data from GWOPA’s database and the various Regional and National WOP Platforms, GWOPA has identified several global trends of WOPs. Overall, the top three thematic areas of focus most important to water operators are non-revenue water (NRW) and water loss, operations and maintenance, as well as asset management. Over half of all WOPs were South-South cooperation, with 49% of partnerships lasting between 12–35 months (medium term duration).

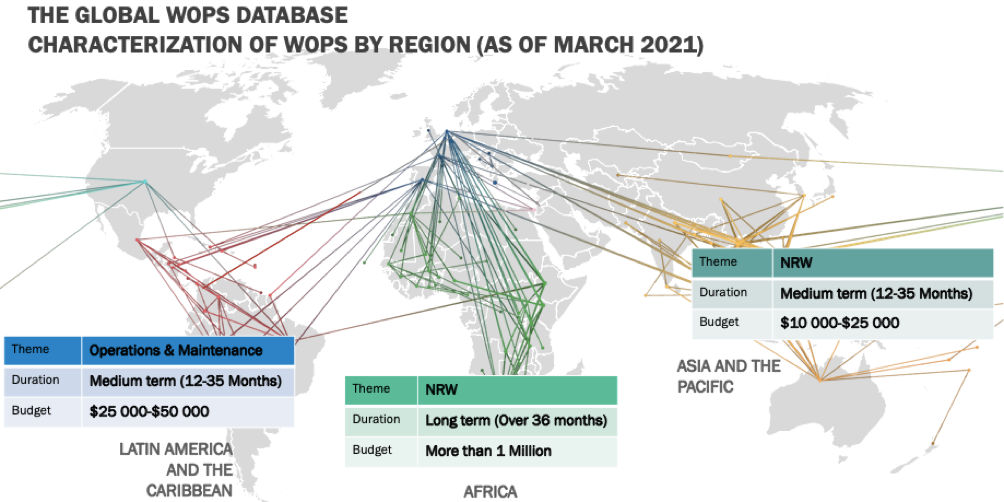

Zooming in by Region

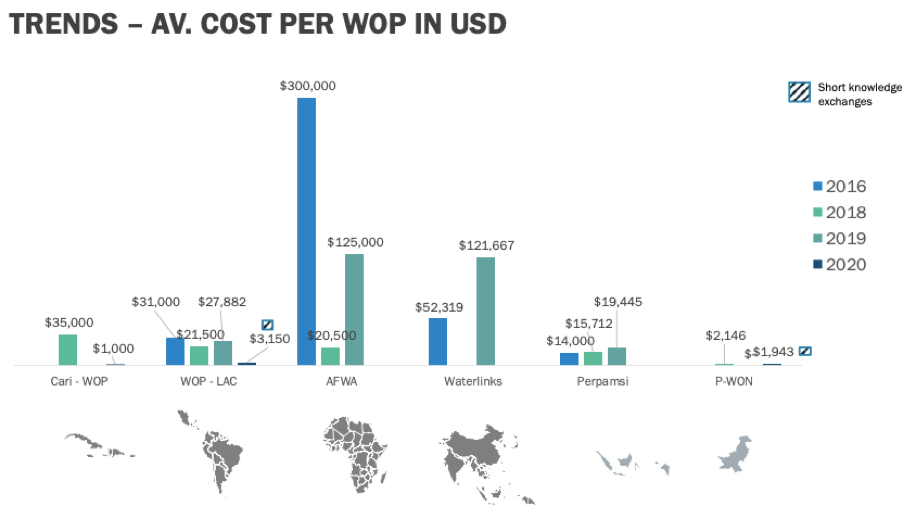

While averages revealed general trends, specific needs and concerns did vary by region. The Latin America and Caribbean (LAC) region had a thematic focus on operations and maintenance, with medium term duration WOPs and budgets ranging from $25,000–$50,000. In Africa the thematic focus was NRW and water loss, with WOPs often lasting over 36 months (long term) and budgets of over a million dollars. Meanwhile, in Asia and the Pacific the thematic focus was also NRW and water loss, but with medium term WOPs and budgets ranging from $10,000-$25,000.

Adapting to Uncertainty and a ’New Normal’

The effects of COVID have rippled into nearly every global sector and facet of daily life. Water operators have had to remain flexible, thinking on their feet to adapt to imposed restrictions while maintaining consistent services to water users in their communities.

Having a network for sharing knowledge and ideas is more important than ever, so that water operators have a space to develop solutions that will work best for their institutions and users.

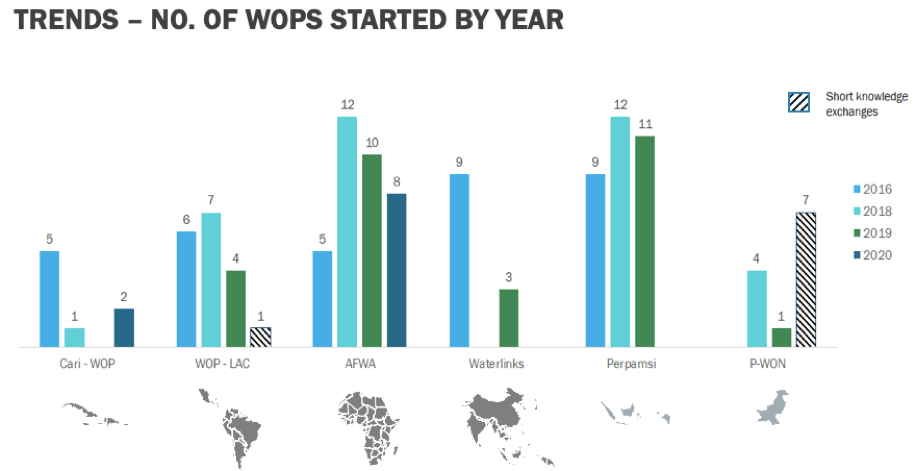

Given the uncertainty that loomed large in 2020, GWOPA saw the establishment of fewer WOPs than in previous years. However, those partnerships which were already under way seemed to draw on each other even more for knowledge and support than before.

There was also a noticeable increase in short knowledge exchanges with budgets under $5,000. This might be an indicator of what’s to come with not only an increase in WOPs, but also an increase in brief, digital exchanges of knowledge with both shorter time durations and smaller budget considerations.

WOPs Facts and Figures

- Top 3 thematic focus areas:

o NRW

o Operations and maintenance

o Asset management - 52% of global WOPs were South-South cooperation

- Across the globe, since 2016, WOPs have had an average duration of over 1.5 years

- Nearly half of all WOPs lasted between 12-35 months (medium term duration)

- In the LAC region, there was a strong focus on operations and maintenance, there were WOPs with medium term durations and had budgets ranging from $25,000–$50,000

- In Africa, the focus was NRW, had WOPs with long term duration and had budgets of over a million dollars

- In Asia and the Pacific region, the focus was NRW, had WOPs with medium term duration and had budgets ranging from $10,000–$25,000

- What role has COVID played in the establishment, development and continuance of WOPs?

o Water operators have had to remain flexible, thinking on their feet to adapt to imposed restrictions while maintaining consistent services to water users in their communities.

o Given the uncertainty that loomed large in 2020, GWOPA saw the establishment of far fewer WOPs overall. However, those partnerships which were already under way seemed to draw on each other even more for knowledge and support than before. - Increase in short knowledge exchanges with budgets under $5,000

o Might be an indicator of what’s to come with not only an increase in WOPs, but also an increase in brief knowledge exchanges with lower threshold of time and budget commitment.